Thomas Fuller once said that ‘the darkest hour is just before the dawn’. I would say we are in a pretty dark hour.

In fact, the last 20 years or so have been a long, dark, fever dream-ish reality that we have been living through. However, despite the mild recession in 2001 and financial crisis of 2008, followed by the global pandemic we are currently experiencing, many are beginning to turn optimistic about the post-pandemic future. But why?

Crises force people to be more innovative.

Look back over history and you will see a trend follow crises that have befallen humanity: Remarkable turnarounds, massive increases in productivity, and surges in innovation. For example, look at the turnaround from the Spanish Flu, which killed approximately 675,000 Americans in about a year’s time.

However, during that time, in-home electricity was becoming commonplace in American households, along with indoor plumbing. Those conveniences enabled adoption of now common appliances into the home: electric refrigerators, washing machines, vacuum cleaners. The way peoples lives were being changed despite the massive repercussions of the most severe pandemic in recent history proves that when faced with crisis, the human spirit is resolute. In comparison, inventions in the works today, driven by pure ambition and innovation, may yet be developed in ways that we least expect.

Baby Boomers are retiring.

The decades following Word War II saw a massive surge in births that would cause both positive and negative long term consequences for the American economy.

Boomers have proven to be an astoundingly productive centerpiece of the American economy. After being born in nearly the perfect point in history, the high-growth and economically booming decades following World War II, they rode the “wave” of economical prosperity into their middle ages despite financial crises such as 1970s energy crisis, OPEC oil price shock, Early 1980s Recession, Black Monday (1987), Savings and loan crisis, Early 1990s Recession, Early 2000s recession, Dot-com bubble, 2007-2009 Financial Crisis, Late-2000s recession, and the most recent COVID-19 recession.

As more than 250,000 retirees not only produce less but also consume and spend less, we can expect to continue seeing impacts on consumer spending, which will bring profound effects to the economy.

This mass exodus of Baby Boomers from the workforce could have a positive effect however—essentially freeing up jobs for younger people who are just now entering the workforce or have been struggling to find employment.

Unprecedented change.

This was the first recession that primarily affected service sectors. The unemployment level rose to four million people who were pushed out of the labor force since February 2020, 55% of which are women. Many had little or no options but to suspend their careers as school closures and health risks disrupted everything from child care and schooling, the food industry, hospitality services, and more.

But while these industries have been put on hold, other industries have benefited from the unfortunate circumstances, to say the least. Grocery stores experienced a massive boost in sales, and their respective supply chains experienced shortages of basic necessities. eCommerce services like Amazon, Alibaba, Shopify, and Alphabet saw massive surges as they quickly became a lifeline for millions of people reluctant to leave their homes. Online video conferencing became the norm for most teams able to work together remotely, and online learning became a household staple. Home exercise companies such as Peloton, Echelon and Nordic Track also saw a massive rise in sales as people were forced to explore other options when their gyms were closed. With all this time being spent inside, the entertainment sector also saw a rise across the board as TV/movie subscription platforms like Netflix, Hulu, Disney Plus, etc. saw increases in subscriber numbers. In other words, the retail apocalypse is here. Industries that are positioned to transition to online commerce and storefront will benefit most from these changes. The collective shift to online may also lead to a drop in demand for office and retail space, including education.

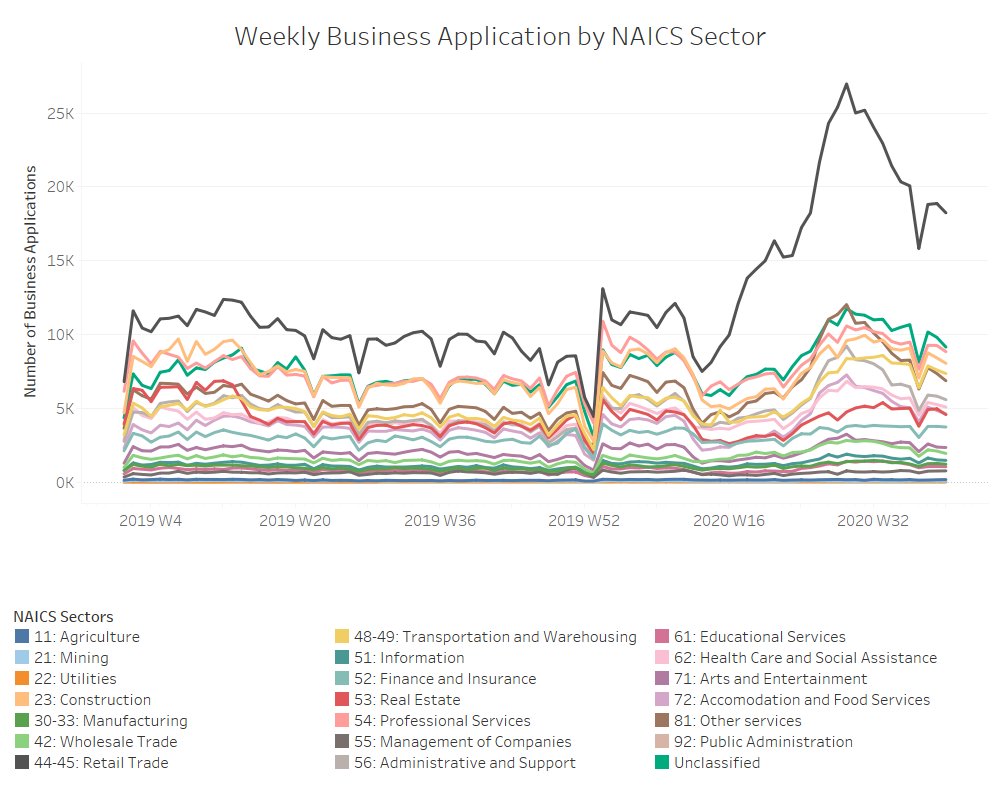

Entrepreneurship is on the rise

Despite the loss of 10.7 million jobs, applications for new businesses are up 42.6% as of January 2021, an indication that despite difficult times, entrepreneurs are following the opportunities that have presented themselves. eCommerce, retail, financial and health services all presently have high demand, and can be run remotely.

If history is any indication (and it is), the strength of the long term economic recovery will be determined by the vitality of this entrepreneurship. New business formations historically power economic recoveries, as new companies take advantage of new opportunities and resources freed up by failed or failing businesses. However, despite the surge in applications, it is important to understand that these are forward looking indicators – it takes time for an application to actually turn into a new business, and not every application completes the journey. (Consider the Census Bureau‘s suggestion that the pace at which applications are actually formed into true active businesses is slower than after the Great Recession.) TLDR: People are increasingly deciding to work for themselves.

Spending Is Set To Increase.

2020 saw not only its fair share of disease, death, and disruption of normal daily life, but also spawned social unrest on a massive scale.

To name only a very select few, Killing of Breonna Taylor, Killing of George Floyd, Ahmaud Arbery protests, Rayshard Brooks protests, Kenosha unrest and shooting, Storming of the United States Capitol Hill.

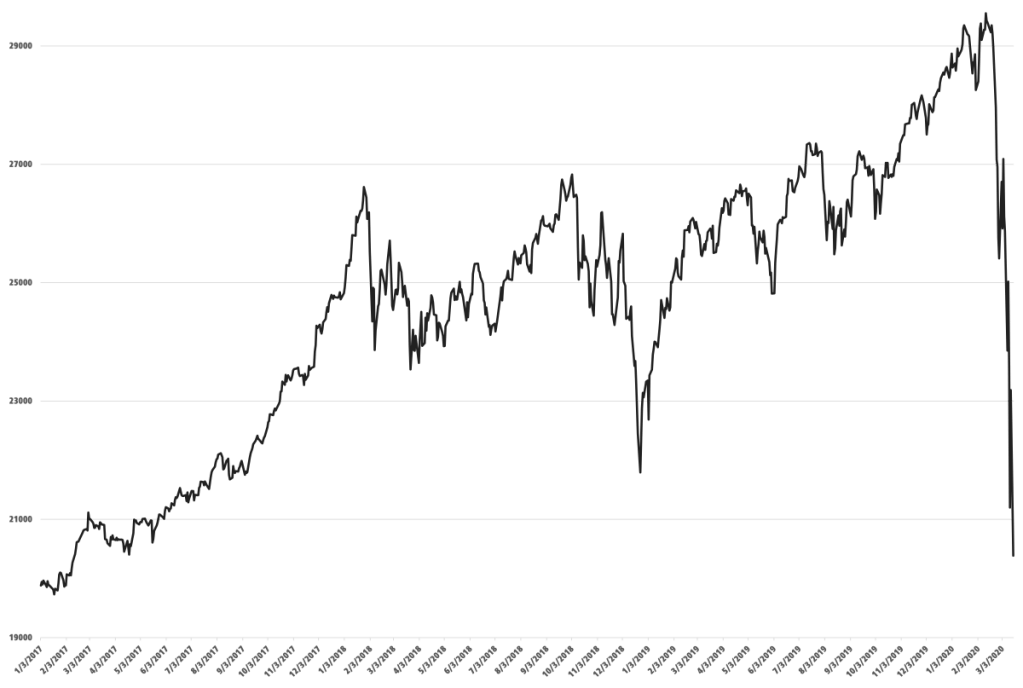

This social unrest spread across the entire country like a rampant cancer that took no quarter. Cities that had just begun to reopen after Covid-19 lockdowns were almost entirely boarded up. In some cities, curfews were imposed. All the while, the U.S. stock market recovered with speed completely divorced from the nation’s emotional or financial sentiment, and labor markets recovered in a manner that far exceeded expectations. By November, unemployment had fallen to 6.7% from 14.7% in April.

During this time, Congress was forced to take a rare break from their daily political business to approve the largest stimulus packages ever passed. These packages were passed not once, not twice, but three times. (CARES Act, Consolidated Appropriations Act, American Rescue Plan). They contained stimulus checks for taxpaying Americans, and Paycheck Protection Programs that helped many small businesses stay afloat. Expanded unemployment benefits (barely) helped the jobless get by and helped sustain spending. As a result, household incomes and expenditures were surprisingly resilient throughout the year and according to studies, the average American now has around $3,500 in median savings.

With that increase in median savings alongside increase in median incomes, the Federal Reserve Bank of Philadelphia predicted that U.S. output will increase 4.5 percent this year, which would make it the best year since 1999. Some expect an even stronger bounce: Economists at Goldman Sachs forecast that the economy will grow 6.8 percent this year and that the unemployment rate will drop to 4.1 percent by December, a level that took eight years to achieve after the last recession.

Maybe, maybe not.

Of course this outlook is far from a certainty. Delays in the vaccine rollout could potentially stall the recovery. As could the looming threat of new strains of COVID-19 that render vaccines less effective. Political standoffs could continue to hold up aid for those most in need. If the economy manages to avoid all of these things, it’s unlikely to be a single moment when public health officials give an “all clear”; it could be years before people pack into bars and sports stadiums the way they did before the pandemic. Other economists fear that the rebound will primarily benefit those at the top, compounding inequities that the pandemic has widened.

- I am not a qualified licensed investment advisor. I am an amateur investor.

- All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or stock picks, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

- I will not and cannot be held liable for any actions you take as a result of anything you read here.

- Conduct your own due diligence or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this site, expressed, or implied herein are committed at your own risk, financial or otherwise.